Learning the benefits of quantitative investment methods first hand

Author: Liz Lemon-Mitchell

Posted on Jul 3, 2019

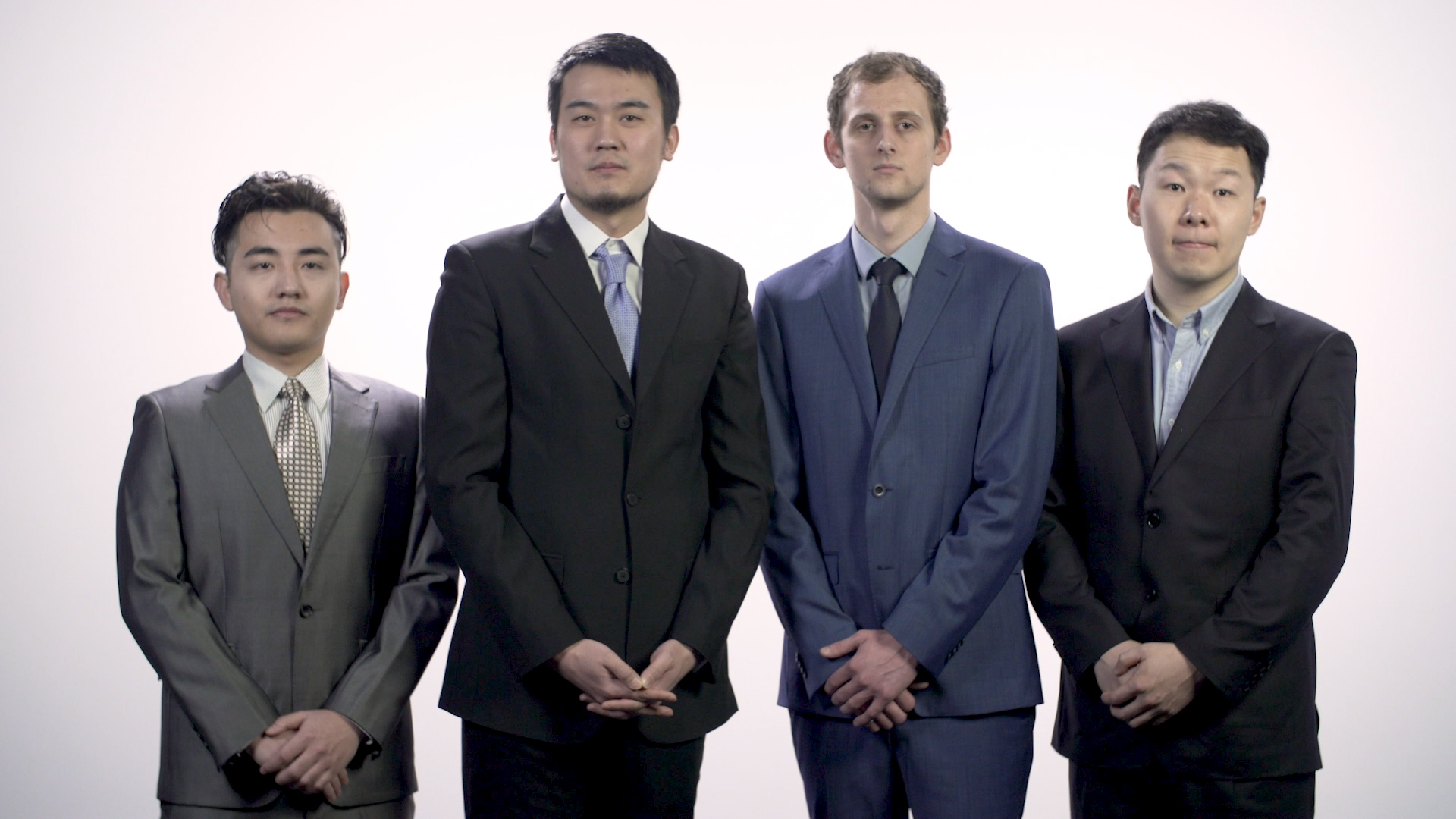

A team of five students enrolled in UNB’s new Master in Quantitative Investment Management (MQIM) program learned the benefits of using quantitative and data rich methods first hand this year by competing in the global Chicago Quantitative Alliance (CQA) Investment Challenge. The team, which included Huang Xu, Jiaji (Justin) Feng, Justin Arsenault, Lowry Zhu and Joseph MacCallum, used the quantitative investment tools they learned in their courses to manage a portfolio and placed 6th out of 48 schools from around the world. Among the Canadian teams that participated, they placed first. This is the first year of the MQIM program and the first time UNB students have ever participated in the Challenge.

The CQA Investment Challenge is an online equity portfolio management competition that offers students the opportunity to learn and apply stock selection and portfolio management skills in a simulated, real life hedge fund experience. The purpose of the Challenge is to provide students with first-hand experience of being a portfolio manager by managing money, explaining their investment process and discussing performance. The students started working on the investment challenge in October and then applied their research and quantitative investment management skills throughout the year to handle all aspects of portfolio management, including stock selection, portfolio construction, and risk management.

The team spent a lot of time and research at the beginning with setting up a factor investing portfolio using Bloomberg and R, then followed a consistent strategy and rebalanced the portfolio regularly throughout the year. In February they had to submit a video presentation to the competition in which they explained their investment philosophy, and provided an update on how their portfolio was performing.

Feng told us, “The scope and requirement for maintaining a portfolio during the competition is quite intensive, but using quantitative tools such as factor-investing models, R and GARCH made managing the portfolio much more efficient, something we learned to appreciate first hand when we had to spend time focusing more on exams and course requirements instead of the portfolio.”

All throughout the competition, a group of instructors with UNB and industry partner Vestcor Inc. helped to mentor the students. Just as the school year was ending, the students and their mentors learned the results.

Jon Spinney, Chief Investment Officer with Vestcor, who mentored the team and also taught one of the courses in the program said, “It’s exciting to see our team place in the top 10 out of the 48 schools around the world who competed. I’m already looking forward to seeing how students do next year.”

“Lack of market place experience is a real barrier to many fresh graduates who are looking for their first job in portfolio management,” said Dr. Devashis Mitra, dean of the Faculty of Management. “By enabling students to apply their research methods to an investment portfolio in this manner, the CQA Investment Challenge has helped this group of students in the first year of our MQIM program stand out in the crowd.”

Photo: Four of the five members of UNB’s CQA Investment Challenge team (L-R) Huang Xu, Jiaji (Justin) Feng, Justin Arsenault and Lowry Zhu.

For more information, contact us at ideas.fom@unb.ca.

Learn more about UNB’s MQIM program.