UNB Student Investment Fund Team Second in the World

Author: Ideas with Impact

Posted on Mar 31, 2015

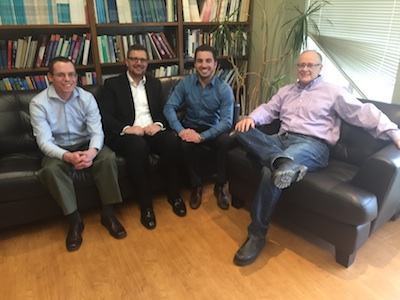

A team of UNB’s Student Investment Fund students placed second in the 2015 Argus University Challenge. Argus is the industry leading software for real estate investment analysis and data-driven decision-making. The team members Daniel Slipp, Jeff Mott  (both MBA candidates) and Josh Bubar (a BBA student) modelled various financial scenarios for a distressed real estate portfolio. The three-building portfolio contained office, retail and industrial buildings that were located adjacent to one of the primary retail areas in the fictional city of Greenville.

(both MBA candidates) and Josh Bubar (a BBA student) modelled various financial scenarios for a distressed real estate portfolio. The three-building portfolio contained office, retail and industrial buildings that were located adjacent to one of the primary retail areas in the fictional city of Greenville.

Each year ARGUS Software offers a “University Challenge” with dozens of universities from all over the world participating. Teams of aspiring real estate professionals, sponsored by a participating professor, are challenged to present a paper with the best investment analysis and conclusion for a fictitious real estate opportunity. UNB’s SIF team submitted a report of their research and recommendations earlier in the term and on March 16th they got the news that they had placed second in the world.

The analysis allowed for an accurate evaluation of the various internal rates of return. The SIF team ultimately decided to model five unique scenarios for each property. The scenarios ranged from minimal capital investment to a full property repositioning effort, which required energy efficiency improvements. Ultimately, the model revealed that the internal rate of return would be maximized by repositioning the properties through extensive renovations and energy efficiency upgrades.

Jeff Mott credited his training through the SIF program for the team’s competitive edge, "The Argus Challenge was a complex case with many moving parts. This called upon all of the skills and experience developed in the SIF program."

The SIF team competed against eighteen other universities from around the globe. The University of San Diego placed first, UNB placed second and Florida International University placed third. The University of Edinburgh received an honourable mention.

Josh Bubar enjoyed the opportunity to apply his training to a real estate investment scenario. "The Argus Challenge provided an excellent opportunity to get out of our comfort zone and apply theoretical valuation concepts to a practical real world asset class,” he said.

Most of the competing schools offer Master of Science in Real Estate programs or have real estate concentrations. The UNB team applied valuation principles acquired through their participation in the Student Investment Fund to the real estate industry. "It is a testament to the Student Investment Fund that our valuation knowledge can be adapted to all forms of asset valuation, “ said Daniel Slipp. “We competed and held our own against some of the best real estate programs in North America."

The Student Investment Fund oversees the management of an eight million dollar portfolio using a balanced fund mandate and equity neutral strategy. The challenge was judged by five leading commercial real estate experts. The students were awarded US$4,000 for their efforts.

By Susan Boyce

For more information contact Liz Lemon-Mitchell