Can prefabricated construction tackle Canada's housing crisis?

Author: OCRC

Posted on Dec 4, 2025

Category: Off-site Construction

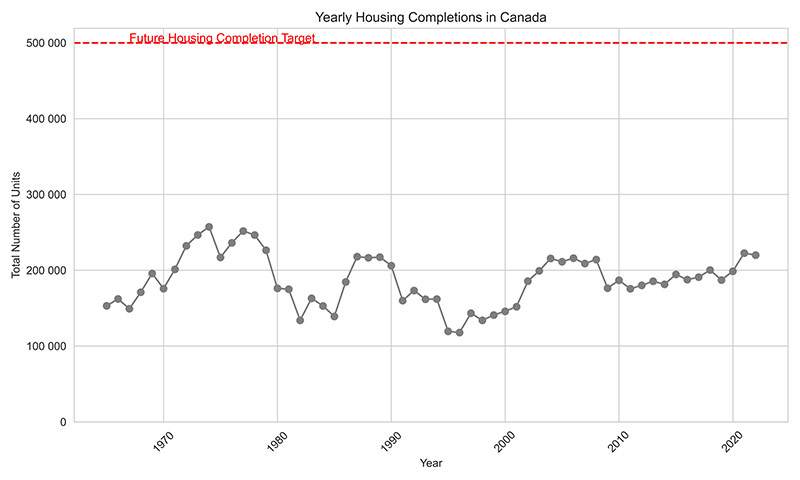

Throughout the 2025 federal election, the conversation around Canada’s housing crisis sharpened its focus on prefabricated construction. With Prime Minister Mark Carney’s target of nearly doubling Canada’s rate of residential construction in ten years to ultimately build 500 000 homes annually, prefabricated construction has become a centrepiece of this conversation.

The historic high for housing completions in Canada is 260 000 homes annually, a figure reached in 1974. In 2024, the number of housing starts in Canada was approximately 245 000 units1.To reach 500 000 annual completions, the need for innovation and scaling-up is clear. With prefabricated construction methods proving reduced construction times of up to 50% and cost reductions up to 20% compared to traditional construction methods, prefabricated construction presents itself as a compelling solution to the ongoing housing crisis.2

Figure 1: Yearly housing completions in Canada. (Data from Statistics Canada)

1 Sondhi, R. (2025, June 3). Canadian Federal Housing Plan: The 500k Marathon. TD Economics. TD Economics - Canadian Federal Housing Plan: The 500k Marathon.

2 Liberal Party of Canada. (2025, March). Mark Carney’s Liberals unveil Canada’s most ambitious housing plan since the Second World War.

Prefabricated construction is an umbrella term covering a wide range of construction methods. Canada's Modern Methods of Construction (MMC) framework, established by the University of New Brunswick’s Off-site Construction Research Centre (OCRC), provides clarity on what is considered prefab. Prefabricated construction covers categories 1-4 in this MMC framework, which includes volumetric modular construction, panelized structural systems, prefabricated components (non-systemized primary structure), and non-structural assemblies and sub-assemblies (such as bathroom and kitchen pods).

Figure 2: Installation of modules. (Image from Government of Ontario)

Recognizing the potential of prefabricated and modular housing, the federal Liberals announced several initiatives to support growth in this industry including $25 billion in debt financing and $1 billion in equity financing to incentivise Canadian prefabricated home builders.2 This builds on existing construction innovation initiatives of the federal government, such as the $50 million of funding in the 2024 federal budget for a Homebuilding Technology and Innovation Fund. This fund intends to help scale up, commercialize, and promote adoption of innovative housing technologies and materials in Canada’s homebuilding industry, including for modular and prefabricated homes.3

While prefabricated construction offers a promising path towards fast and affordable housing, there is limited publicly available data on the capacity of this emerging industry. As it stands, modular construction represents 7.5 percent of the overall Canadian construction market (the overall market is values at $5.1 billion Canadian dollars).4 While this market share information is useful for understanding the adoption and economic significance of modular construction, details are lacking on the specific production outputs. Beyond the market share, the Modular Building Institute reports that 84% of Canadian modular manufacturers surveyed reported some or significant unused capacity, however the size of this unused capacity is not quantified.

Even with the promised support of the federal government, the question remains: does the prefabricated construction industry have the capacity to scale up and meet expectations? In theory, prefabricated construction is poised to play a major role in tackling Canada’s housing crisis, but there is limited data on the production output and growth potential of this industry. The federal government is asking a lot of prefabricated construction, yet how much it can produce, and how quickly can it scale up, remains unquantified (or at least unreported). Access to this data is crucial not only for policymakers but also for industry decisions and the non-profit housing sector. To understand how far the industry can go, we must first understand where it is.

The OCRC began preliminary exploration of current production outputs for prefabricated construction, drawing on the SCIUS Advisory Prefab Navigator database. This dataset was filtered to focus on modular manufacturers in residential construction. Using a very small sample of companies with known output and facility size, a model was fitted to generate estimates of production capacity based on manufacturing facility size. However, due to the limitations of the dataset, uncertainty in the training inputs, and strong assumptions required for extrapolation, this approach introduces significant uncertainty and is not reliable for precise industry-wide estimation. A definitive measure of industry output would require additional data and in-depth analysis.

While exact production outputs are not consistently reported, housing starts are a well-reported figure and are a starting point for understanding the current production output of the residential housing sector. The data on housing starts, housing under construction, and housing completions across Canada are reported yearly through Statistics Canada and the Canada Mortgage and Housing Corporation3. However, these overall housing starts numbers are not specific to construction methods. We know how many homes are being built, but we lack the data on how these homes are built.

3 CMHC. (2024, May 16). What is Canada’s potential capacity for housing construction? Canada Mortgage and Housing Corporation.

4 Modular Building Institute. (2025, June 18). Canadian Permanent Modular Construction Industry Report.

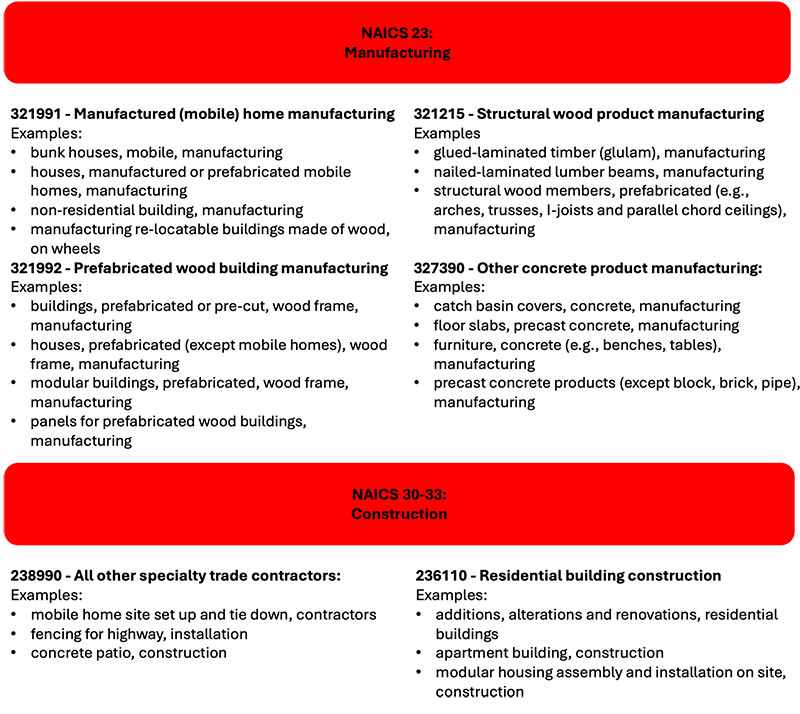

To dive deeper into the publicly available information on prefabricated housing construction, we turn to available Statistics Canada data. To separate data based on industry, Statistics Canada uses the North American Industry Classification System (NAICS), a hierarchical system used to classify businesses based on their economic activities. It is divided into 20 sectors then into smaller subsectors and individual industries.5 Prefabricated housing construction can be considered through two distinct sectors: construction (NAICS 23) and manufacturing (NAICS 31-33). Within the construction sector, residential building construction, including the construction of modular housing, is classified under code 236110. However, this does not capture all housing construction since manufactured homes (also called mobile home) set up and tie-down work is classified under a different code and manufactured home construction is lumped in with miscellaneous construction such as playground equipment installation. As such, NAICS cannot cleanly separate the relevant data without also capturing unrelated categories.

A similar issue arises when considering the NAICS categories for the manufacturing sector. While there are distinct NAICS codes for manufactured (mobile) homes (321991) and prefabricated wood buildings (321992), which includes modular homes and wood panels for prefabricated buildings (both are considered category 1 in the MMC framework). Other prefabricated components are not categorized distinctly. For example, the NAICS category for Structural wood product manufacturing includes prefabricated components such as floor and roof trusses and mass timber products (category 2 of the MMC framework), but it also includes wood components used in traditional construction methods, making this category challenging to distinguish between prefab and traditional methods of construction. This extends to precast concrete products as well. Precast concrete is included in the NAICS category for Other concrete product manufacturing (code 327390) which includes precast concrete products relevant to housing construction but also includes miscellaneous products such as concrete furniture and catch basin covers.

The complexity of isolating prefabricated construction through NAICS codes is prohibitive for extracting relevant data from existing Stats Can datasets. Additionally, some of these tables do not report to the lowest level of NAICS creating a lack of detail for extracting prefab-specific data.

5 Statistics Canada. (2024). North American Industry Classification System (NAICS) Canada 2022 Version 1.0.

Figure 3: Summary of relevant NAICS categories with examples of ambiguity and overlap in terms of prefabricated construction and manufacturing.

To quantify the production output of the prefab construction industry, these data/reporting gaps need to be addressed. Once these metrics are well established, they can be used alongside labour market information and other key industry factors to forecast the readiness of the prefabricated construction industry to increase production and take advantage of the support and funding coming from the federal government.

Canada’s current housing goals (and the messaging around these targets) are strongly relying on the promise of prefabricated construction. With data supporting the potential speed and cost advantages of prefab, the industry could scale up and play a major role in meeting the nation’s housing goals. However, the lack of publicly available data on the output and capacity of the industry is a barrier to assessing its readiness for meeting the scale of the challenges ahead.

Want to learn more about prefabricated construction?

The Off-site Construction Research Centre (OCRC) at the University of New Brunswick is leading the way in construction innovation. Through cutting-edge research and industry-driven projects, the OCRC is where collaboration meets impact.

Explore our work: Project profiles | Off-site Construction Research Centre | UNB to learn more, connect with our team and see what we’re building next.