Tom Liston: The impact of COVID-19 on your investments

Author: UNB Alumni

Posted on Jun 30, 2020

Category: Insights , Management

Tom Liston (BBA'96) is one of the most sought-after minds in Canada's tech investment sector and has offered his insights into the current market.

Large declines in your investment portfolio often bring an understandably emotional response.

Many investors’ first thoughts are to ‘protect’ their portfolios by selling. Others look at these market moves as an opportunity to ‘buy the dip’.

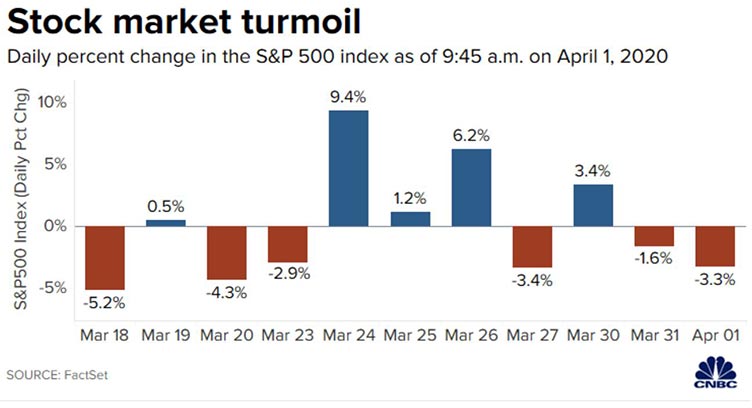

Most often, our first reaction is an emotional one, which is not necessarily the best course of action. The current volatility is evidence of this. The S&P 500 (an index which measures the stock performance of 500 large companies listed in the US) has averaged five per cent intraday moves in March 2020, the most for any month on record. For comparison, during the middle of the Depression or the global financial crisis of 2008, the average monthly swing never surpassed four per cent moves intraday. This volatility can increase the magnitude of mistakes made by an emotional first reaction.

We are dealing with essentially three shocks at the same time: a health shock, an economic shock (imposed by governments to deal with the former) and a financial credit shock. The responses by governments to the shocks caused by the COVID-19 pandemic are certainly difficult and complex, particularly when it comes to balancing the need to lock down populations versus considerations for the length of an economic recession - and preventing it from becoming a depression.

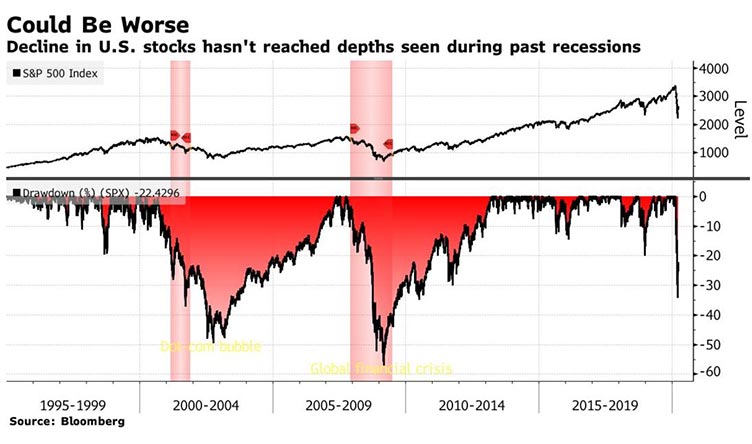

Despite the recent stock market decline, there is reason to remain cautious in the near term. Note: despite the severity of these shocks, the S&P 500 Index has not declined as far as it did in the two most recent recessions.

The market often bottoms approximately three months before Gross Domestic Product (GDP) numbers do. In the recent Canada’s Parliamentary Budget Officer (PBO) report published on March 27th, their economic scenario calls for a 25 per cent year-over-year decline in GDP for the second quarter (ending June 30) this year. With the recent commentary from government officials, we may see an extension of lockdown activities which would lead to continued depressed economic activity. The PBO’s scenarios show a further 1.4 per cent decline in the third quarter, which could see further negative revisions.

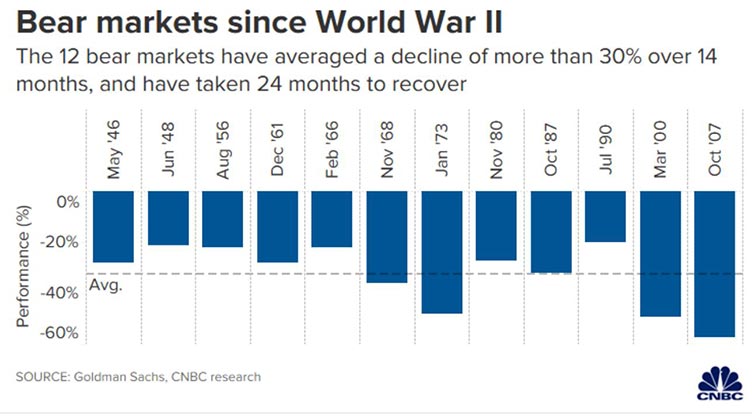

Using history as a guide, market recovery takes time. Since World War II, the twelve bear markets (defined by a 30 per cent decline from peak-to-trough in the market) have taken 24 months before they fully recover. Bear markets have also taken 14.5 months for their peak-to-trough decline, whereas this COVID-19 bear market decline was triggered in approximately five weeks.

Experience has taught us to be cautious and patient. However, it is also key to avoid ‘panic’ selling and to maintain a weighting in equities consistent with your financial plan and risk tolerance. There is an important lesson as to why: Bank of America looked at market data going back to 1930 and found that if an investor missed the S&P 500′s 10 best days in each decade, total returns would be just 91 per cent. If one held on through these downturns? Their returns were 14,962 per cent, a stark contrast.

Stay safe - and hold steady.